Jan 04, 2017 The Role of Business Modeling in Improving Profitability

Most business owners believe that raising sales or lowering costs will lead to increased profits. The reality is that it depends on many factors such as the cost of raising sales, the cost of providing additional units of a product or hours of a service, etc.

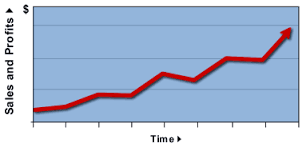

Relationship Between Sales and Profits in Increasing Profitability

For example, in manufacturing, the incremental cost of producing additional units of a product might be lower than their average existing cost in which case as long as the cost of acquiring additional sales was not higher than the acquisition cost per unit today, the result would be increased profits. Of course, the reverse might also be true.

In a service business that depends on people to deliver a service, the cost of additional hours/workers might be higher than the cost of the existing staff. It might require more office space, trucks or other equipment. Let’s not forget the cost of acquiring the new sales. Advertising, discounts, sales people, new locations, etc. all cost money.

If you are able to increase the perceived value of your product and can increase prices, all other things the same, this will increase profits. However, if it is achieved by celebrity endorsements or extensive advertising to establish a brand name, the situation presents trade-offs.

So while increasing sales often will increase profits, there are many situations where this is not true. But more than these simplified examples, it is the interaction of all of the moving parts of a company and its customers changing at the same time that determines the outcome.

Focus

A key factor in efforts to increase profitability is that the business owner can only focus on a finite number of profit improvement initiatives at a time. So understanding which actions they can take that will have the greatest effect on profitability and how realistic it is to carry out those actions with the financial resources and staff available to them is critical.

Business Modeling

This is where business modeling comes in. A business model is a mathematical representation of a business and captures all of the relationships of pricing, marketing, cost of production, servicing customers, etc. It is NOT a set of projected financial statements though the model contains enough information to produce these. Much analysis is required to derive the relationships that make up the model.

Once a model is constructed, the next step is to validate that with inputs that reflect current conditions, the model produces results that approximate current results. Additional tests to verify that past results can also be reproduced can be valuable.

Then what-if scenarios can be run to determine which factors most affect profitability. As someone who has be building and using business models on and off for thirty years, I can tell you that predicting which factors are most important before constructing the model is not that easy. While I can make a list of the ten most likely factors that will affecting profitability before the model is constructed, it is often the case that at least one more factor emerges from the sensitivity analysis. In addition, it is difficult to predict which of the ten will be most impactful.

Planning and Execution of Profit Improvement Initiatives

Once the key factors which affect profitability are identified, they need to be vetted to figure out which are feasible within the resources available, the likelihood of success of each, the sequencing and timing. The last steps are to craft plans (marketing plans, process improvements, pricing strategies, etc.), begin execution and monitor the results.

As you can see, business modeling is a valuable tool in improving a company’s profitability.

I will be exploring many topics that affect a company’s profitability in this column such as pricing, promotions, cost savings and efficiencies, capacity constraints, product or service quality, support services, marketing effectiveness, etc.

Sorry, the comment form is closed at this time.